Recent Searches

Popular Courses:

How Banks And Financial Markets Work?

Financial Market Overview

What is happening to Financial Market?

How Banks And Financial Markets Work?

How Banks And Financial Markets Work? Financial Market Overview

Financial Market Overview What is happening to Financial Market?

What is happening to Financial Market?

This course will help you understand how effectively you can put your money to work and how the magic of compounding helps it grow in value. You will learn about the ways and means to invest and the prerequisites of investing efficiently. We have covered topics which shall help you identify various risks to be considered while planning your investment.

Risk always comes with some degree of reward. Here in this course, we will deeply help you understand the relationship between risk and reward and its impact on pricing. Lastly, the course also highlights the importance of risk management in investing.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

The stock market allows companies to raise money by offering stocks, shares, bonds etc. This is the foundation course for equity investment. We aim to make you understand every nitty-gritty related to the stock market. The course shall start by explaining the basics of a stock market, frequently used important terminologies, and the functioning of the stock market. You will learn about what a stock is, the process of buying and selling stocks, and the factors determining the prices of the stocks. You will be acquainted with the risk of investing in a stock market and its management. We shall also name a few famous stock exchanges, which are treated as a benchmark by many.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

This course on IPO is for beginners who want to understand the process from scratch. IPO is one of the most sought-after investment options across the globe. You will get to know about the process and procedure of filling an IPO. The course will help you read and understand the prospectus of an IPO. It will educate you about the valuation methods used for IPO valuation. The course explains the role of IPO participants in making floatation successful. You will also be able to understand the modern and upcoming trends in the IPO.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

.png)

Technical Analysis keeps a prominent space in the security analysis, which uses past market data to predict future prices. This course will help you understand the nuances of Technical analysis, which is necessary to create a foundation for understanding various basic and advanced technical tools.

This course puts forward an arsenal of strategies for helping the investor choose the investing style as per their goals and needs. Investing strategies are one of the most crucial tools used by investors to minimise their risk and maximise their rewards. This investment strategy course will teach you the importance of strategy selection. You will be introduced to all the essential investment strategies and the way to select the most suitable one for you.

By the end of this course, you will be able to determine the benefits of all the major investment strategies and the common mistakes made while selecting anyone.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

This course starts with the basic understanding of corporate finance for the learners, who want to have the fundamental skills and insight of corporations’ handling of finances.

The study centers around key concepts for evaluating investment opportunities. By the end of the course, you shall be able to calculate return on investment, how to value stocks and bonds, and how to value an asset. They form an essential part of corporate finance along with understanding corporations’ capital structuring and budgeting techniques.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Candlestick Patterns play a vital role in predicting the future price direction and mastering these patterns will help an individual in sailing the market with ease. This course is designed from elementary level to explain the basics of candlestick formations with specific examples for practical application.

Indicators and Oscillators play a critical role in technical analysis, combined with price action and other technical analysis tools, they provide a powerful insight on price trends. This course delivers complete guidance on using trend-following, momentum, volume and volatility indicators to understand the continuation or possible reversal of the price trend.

This is the best course to let you understand how a project is organised and executed. This course will let you know all the required project planning techniques, the risks, and how to manage them. By the end of the course, you will be able to understand all the required traits of a successful project manager.

Sick of rigorous lesson plans and long study

hours?

Unlock your best potential and career opportunities with Kal-Edtech+!

Dividends offer an additional layer of security for stock market investors as they offer guaranteed income. Investors can obtain secured returns from a stock, even if there are no capital gains received on it. This course explains some of the fundamental concepts attached to dividend investing and how investors can utilise dividends to elevate their investments.

Basic

Basic

This course will set different stepping stones for the preparation of a secure retirement. Upon completion, you will be able to assess your tolerance for risk while planning a retirement. You can evaluate various investment options available and build an investment mindset for your golden days. Also, this course will provide all the fundamental knowledge for those looking to be an advisor in the financial services industry.

Basic

Basic

This is the best course to let you understand how a project is organised and executed. This course will let you know all the required project planning techniques, the risks, and how to manage them. By the end of the course, you will be able to understand all the required traits of a successful project manager.

Basic

Basic

Candlestick Patterns play a vital role in predicting the future price direction and mastering these patterns will help an individual in sailing the market with ease. This course is designed from elementary level to explain the basics of candlestick formations with specific examples for practical application.

Basic

Basic

This course on IPO is for beginners who want to understand the process from scratch. IPO is one of the most sought-after investment options across the globe. You will get to know about the process and procedure of filling an IPO. The course will help you read and understand the prospectus of an IPO. It will educate you about the valuation methods used for IPO valuation. The course explains the role of IPO participants in making floatation successful. You will also be able to understand the modern and upcoming trends in the IPO.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Basic

Basic

The stock market allows companies to raise money by offering stocks, shares, bonds etc. This is the foundation course for equity investment. We aim to make you understand every nitty-gritty related to the stock market. The course shall start by explaining the basics of a stock market, frequently used important terminologies, and the functioning of the stock market. You will learn about what a stock is, the process of buying and selling stocks, and the factors determining the prices of the stocks. You will be acquainted with the risk of investing in a stock market and its management. We shall also name a few famous stock exchanges, which are treated as a benchmark by many.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Basic

Basic

The course has been designed to familiarise users with the art of dividend re-investing. It covers some of the basic concepts such as how reinvestment works, DRIPs, types of DRIPs and the advantages and disadvantages of reinvesting. The course also shed light on instances where reinvestment is the right choice and when taking a cash payment is a better option.

Intermediate

Intermediate

Alternative investments have quickly gained pace and have become the investor’s choice when it comes to building a diversified portfolio. Alternative investments can offer variety against the more traditional forms of investments, such as stocks and bonds.

Intermediate

Intermediate

The earnings report is an official financial document to be released by all public companies. This course will help you learn how to apply different analytical methods to critical financial statements and understand how these methods help in making informed business decisions.

Intermediate

Intermediate

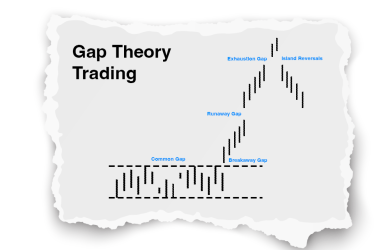

A break in the chart continuity is considered a 'Gap' by the chartists, which can create panic among the market participants. However, understanding these Gaps plays a vital role in security analysis and helps in performance improvement.

Intermediate

Intermediate

Banks and Financial Markets are an integral part of the economy. The course on the workings of banks and financial markets will help you understand the functions and operations of the financial markets. The course focuses on how financial markets work and what are the roles of financial institutions. What are the different functions of a bank, and how do they mitigate risks while operating. It also deals with the international and digital banking aspects.

Intermediate

Intermediate

Indicators and Oscillators play a critical role in technical analysis, combined with price action and other technical analysis tools, they provide a powerful insight on price trends. This course delivers complete guidance on using trend-following, momentum, volume and volatility indicators to understand the continuation or possible reversal of the price trend.

Intermediate

Intermediate

.png)

Everyone loves to invest and see their money grow; however, simple investing and investing in a prudent way are two different things. One needs to acquire some must-have basic skills if they want to invest like a pro.

If you are a kind of person who believes in planning systematically, for long term, also hold some prior knowledge and experience, this is the best course to hone your skills and learn the multifaceted approach to investing.

You can also go through our course “Learn the joy of investing” to gather all the basic investing tips.

Advanced

Advanced

Options are derivatives used worldwide to hedge the portfolio and maximize its performance. Options are risky yet worthwhile financial instruments if used with proper knowledge, and this course will help you in mastering them. This course delivers complete guidance, starting with the basics of Options to the Options Strategies, so you can take analysis-driven decisions for portfolio building.

Advanced

Advanced

This course starts with the basic understanding of corporate finance for the learners, who want to have the fundamental skills and insight of corporations’ handling of finances.

The study centers around key concepts for evaluating investment opportunities. By the end of the course, you shall be able to calculate return on investment, how to value stocks and bonds, and how to value an asset. They form an essential part of corporate finance along with understanding corporations’ capital structuring and budgeting techniques.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Advanced

Advanced