Introduction To Dividend Reinvesting

The course has been designed to familiarise users with the art of dividend re-investing. It covers some of the basic concepts such as how reinvestment works, DRIPs, types of DRIPs and the advantages and disadvantages of reinvesting. The course also shed light on instances where reinvestment is the right choice and when taking a cash payment is a better option.

Intermediate

Intermediate

Level Up Investing With Dividends

Dividends offer an additional layer of security for stock market investors as they offer guaranteed income. Investors can obtain secured returns from a stock, even if there are no capital gains received on it. This course explains some of the fundamental concepts attached to dividend investing and how investors can utilise dividends to elevate their investments.

Basic

Basic

How To Build An Alternative Investments Portfolio

Alternative investments have quickly gained pace and have become the investor’s choice when it comes to building a diversified portfolio. Alternative investments can offer variety against the more traditional forms of investments, such as stocks and bonds.

Intermediate

Intermediate

Decoding Earnings Report

The earnings report is an official financial document to be released by all public companies. This course will help you learn how to apply different analytical methods to critical financial statements and understand how these methods help in making informed business decisions.

Intermediate

Intermediate

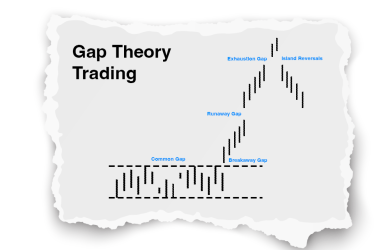

Gap Theory Trading

A break in the chart continuity is considered a 'Gap' by the chartists, which can create panic among the market participants. However, understanding these Gaps plays a vital role in security analysis and helps in performance improvement.

Intermediate

Intermediate

.png)

How You Can Invest Like A Pro

Everyone loves to invest and see their money grow; however, simple investing and investing in a prudent way are two different things. One needs to acquire some must-have basic skills if they want to invest like a pro.

If you are a kind of person who believes in planning systematically, for long term, also hold some prior knowledge and experience, this is the best course to hone your skills and learn the multifaceted approach to investing.

You can also go through our course “Learn the joy of investing” to gather all the basic investing tips.

Advanced

Advanced

A Complete Guide To Options Trading

Options are derivatives used worldwide to hedge the portfolio and maximize its performance. Options are risky yet worthwhile financial instruments if used with proper knowledge, and this course will help you in mastering them. This course delivers complete guidance, starting with the basics of Options to the Options Strategies, so you can take analysis-driven decisions for portfolio building.

Advanced

Advanced

How To Plan And Prepare For Your Retirement

This course will set different stepping stones for the preparation of a secure retirement. Upon completion, you will be able to assess your tolerance for risk while planning a retirement. You can evaluate various investment options available and build an investment mindset for your golden days. Also, this course will provide all the fundamental knowledge for those looking to be an advisor in the financial services industry.

Basic

Basic

How Banks And Financial Markets Work

Banks and Financial Markets are an integral part of the economy. The course on the workings of banks and financial markets will help you understand the functions and operations of the financial markets. The course focuses on how financial markets work and what are the roles of financial institutions. What are the different functions of a bank, and how do they mitigate risks while operating. It also deals with the international and digital banking aspects.

Intermediate

Intermediate

How To Become A Successful Project Manager

This is the best course to let you understand how a project is organised and executed. This course will let you know all the required project planning techniques, the risks, and how to manage them. By the end of the course, you will be able to understand all the required traits of a successful project manager.

Basic

Basic

Indicators and Oscillators

Indicators and Oscillators play a critical role in technical analysis, combined with price action and other technical analysis tools, they provide a powerful insight on price trends. This course delivers complete guidance on using trend-following, momentum, volume and volatility indicators to understand the continuation or possible reversal of the price trend.

Intermediate

Intermediate

A Complete Guide to Candlestick Patterns

Candlestick Patterns play a vital role in predicting the future price direction and mastering these patterns will help an individual in sailing the market with ease. This course is designed from elementary level to explain the basics of candlestick formations with specific examples for practical application.

Basic

Basic

All About Corporate Finance

This course starts with the basic understanding of corporate finance for the learners, who want to have the fundamental skills and insight of corporations’ handling of finances.

The study centers around key concepts for evaluating investment opportunities. By the end of the course, you shall be able to calculate return on investment, how to value stocks and bonds, and how to value an asset. They form an essential part of corporate finance along with understanding corporations’ capital structuring and budgeting techniques.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Advanced

Advanced

Investment Strategies and their importance

This course puts forward an arsenal of strategies for helping the investor choose the investing style as per their goals and needs. Investing strategies are one of the most crucial tools used by investors to minimise their risk and maximise their rewards. This investment strategy course will teach you the importance of strategy selection. You will be introduced to all the essential investment strategies and the way to select the most suitable one for you.

By the end of this course, you will be able to determine the benefits of all the major investment strategies and the common mistakes made while selecting anyone.

Achieve excellence. Purchase our Kal-Edtech+ courses TODAY!

Intermediate

Intermediate

.png)

Introduction to Technical Analysis

Technical Analysis keeps a prominent space in the security analysis, which uses past market data to predict future prices. This course will help you understand the nuances of Technical analysis, which is necessary to create a foundation for understanding various basic and advanced technical tools.

Intermediate

Intermediate